Introduction

Have you ever worked hard to complete a project for a customer, only to wait weeks or even months to receive payment? This delay in receiving payment, often referred to as slow-paying customers, can create a cash flow crunch for your business. This is where invoice funding comes in.

Understanding invoice finance, its method, and its benefits can be critical for businesses of all sizes, particularly those experiencing cash flow issues owing to slow-paying customers. This blog attempts to provide a clear and straightforward description of this funding alternative in plain language so that anyone can understand the concept.

What is Invoice Funding?

Invoice funding, also known as accounts receivable financing or receivables financing, is a type of short-term financial solution for businesses. It enables them to borrow money against outstanding bills sent to clients. In simpler terms, you can think of it as using your outstanding invoices as a source of funding to bridge the gap between completing work and receiving payment.

Here’s how it works:

1. You complete a project or deliver goods and services to a customer.

2. You issue an invoice to your customer for the agreed-upon amount.

3. You approach an invoice financing company and “sell” them your unpaid invoice.

4. The invoice financing company advances you a portion, typically up to 90%, of the invoice value.

5. Once your customer pays the invoice, the financing company deducts their fees and remits the remaining amount to you.

Read Also: GST E-invoicing System

The Process of Invoice Funding

The process of invoice funding is typically straightforward and involves several key steps:

1. Selecting an Invoice Financing Company: Research and compare different companies to find one that offers competitive rates and terms that suit your business needs.

2. Submitting Your Application: Provide the financing company with your business information, financial statements, and a sample invoice.

3. Approval and Agreement: Upon approval, you will enter into a formal agreement with the financing company outlining the terms, fees, and conditions of the service.

4. Selling Your Invoice: Once you issue an invoice to your customer, you can submit it to the financing company for them to “purchase.”

5. Receiving Advance Payment: The financing company will advance you a portion of the invoice value, typically within a few business days.

6. Customer Payment and Settlement: Once your customer settles the invoice, the financing company will deduct their fees and remit the remaining balance to you.

Benefits of Invoice Funding

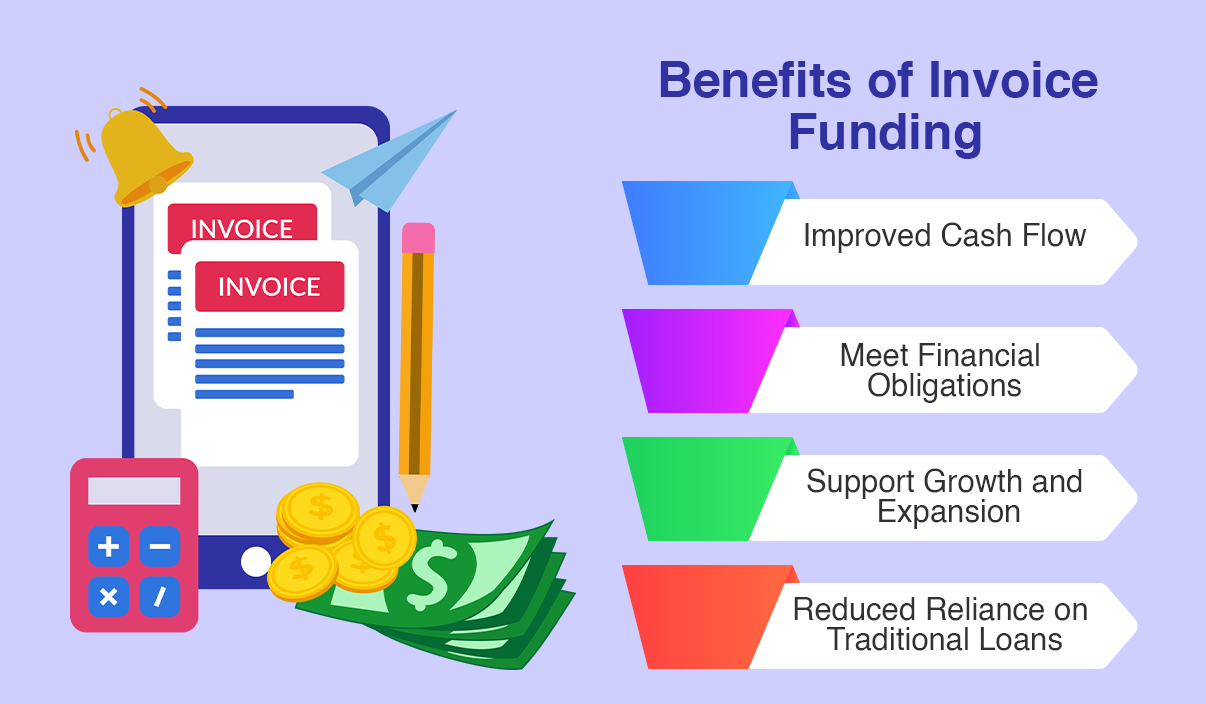

Invoice funding can offer several advantages for businesses, particularly those struggling with slow-paying customers or limited access to traditional financing options:

▪ Improved Cash Flow: By receiving an advance payment on your invoices, you can bridge the gap between completing work and receiving customer payments, allowing you to manage your cash flow more effectively.

▪ Meet Financial Obligations: Timely access to funds can help you meet your financial obligations, such as paying employees, suppliers, and other bills, without compromising your operations.

▪ Support Growth and Expansion: Improved cash flow through invoice funding can enable you to invest in new opportunities, expand your business, or take advantage of emerging market trends.

▪ Reduced Reliance on Traditional Loans: Businesses facing difficulties obtaining traditional loans or lines of credit can leverage invoice funding as an alternative financing solution.

How to Get Started with Invoice Funding

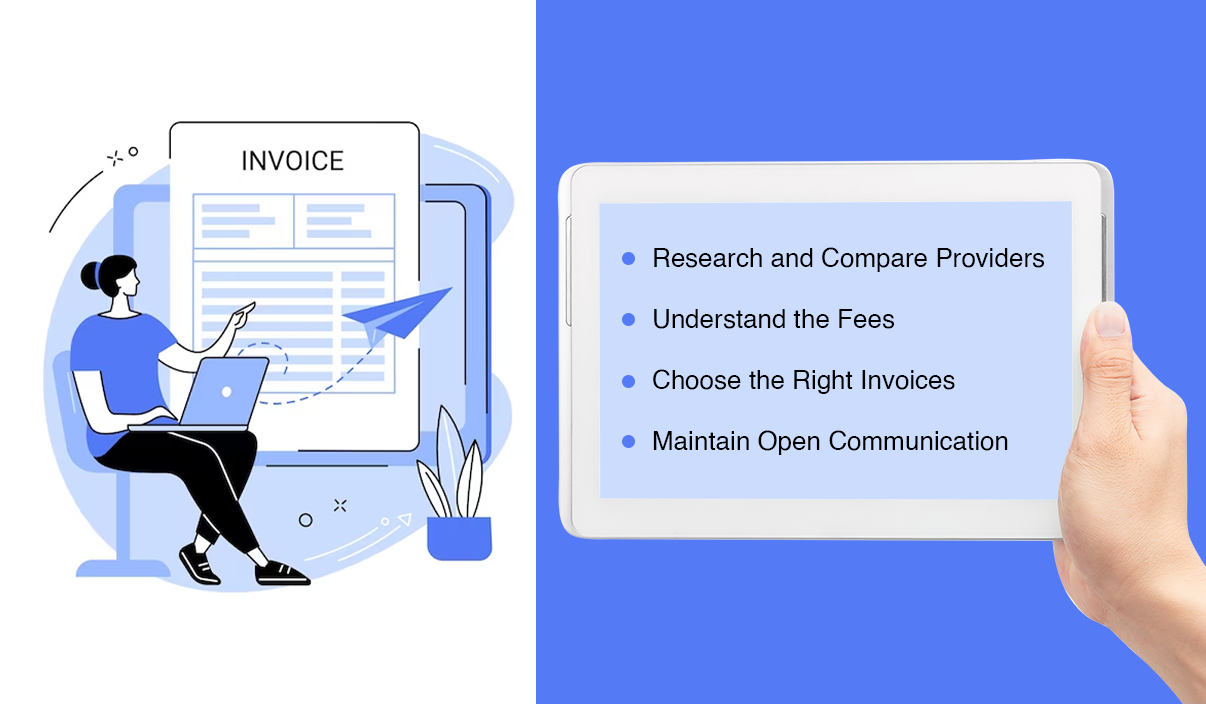

If you are considering invoice funding as a potential solution for your business, here are some helpful tips:

➤ Research and Compare Providers: Take time to research and compare different invoice financing companies to find one that offers competitive rates, terms, and services that align with your business needs.

➤ Understand the Fees: Be clear on the fees associated with invoice funding, such as advance rates, processing fees, and any additional charges.

➤ Choose the Right Invoices: Select invoices from creditworthy customers with a good track record of timely payments to minimize risk and ensure a smooth experience.

➤ Maintain Open Communication: Maintain clear communication with both your customers and the financing company throughout the process to avoid any misunderstandings.

Read Also: Know What Are the Mandatory Fields in an e-Invoice

Different Types of Invoice Funding

While the core concept of invoice funding remains the same, there are two main types to consider:

Recourse vs. Non-Recourse Funding:

▪ Recourse Funding: In this type, if your customer fails to pay the invoice, you are responsible for repaying the advance received from the financing company. This usually comes with lower fees due to the shared risk.

▪ Non-Recourse Funding: This offers protection from bad debts as the financing company assumes the risk of non-payment by your customer. However, non-recourse funding typically comes with higher fees due to the increased risk taken by the financing provider.

Additional Considerations When Choosing an Invoice Funding

Beyond the basic comparison of rates and terms, several additional factors can influence your decision when choosing an invoice financing company:

Minimum Invoice Amount: Some companies have minimum invoice amounts they are willing to “purchase,” which may not be suitable for businesses with smaller invoices.

Industry Expertise: Consider partnering with a company that has experience and expertise in your specific industry.

Customer Service and Reputation: Choose a company known for its responsiveness, transparent communication, and positive reputation in the industry.

Technology Integration: Look for a company that offers seamless integration with your existing accounting software or invoicing system, streamlining the process and saving you time.

Alternatives to Invoice Funding

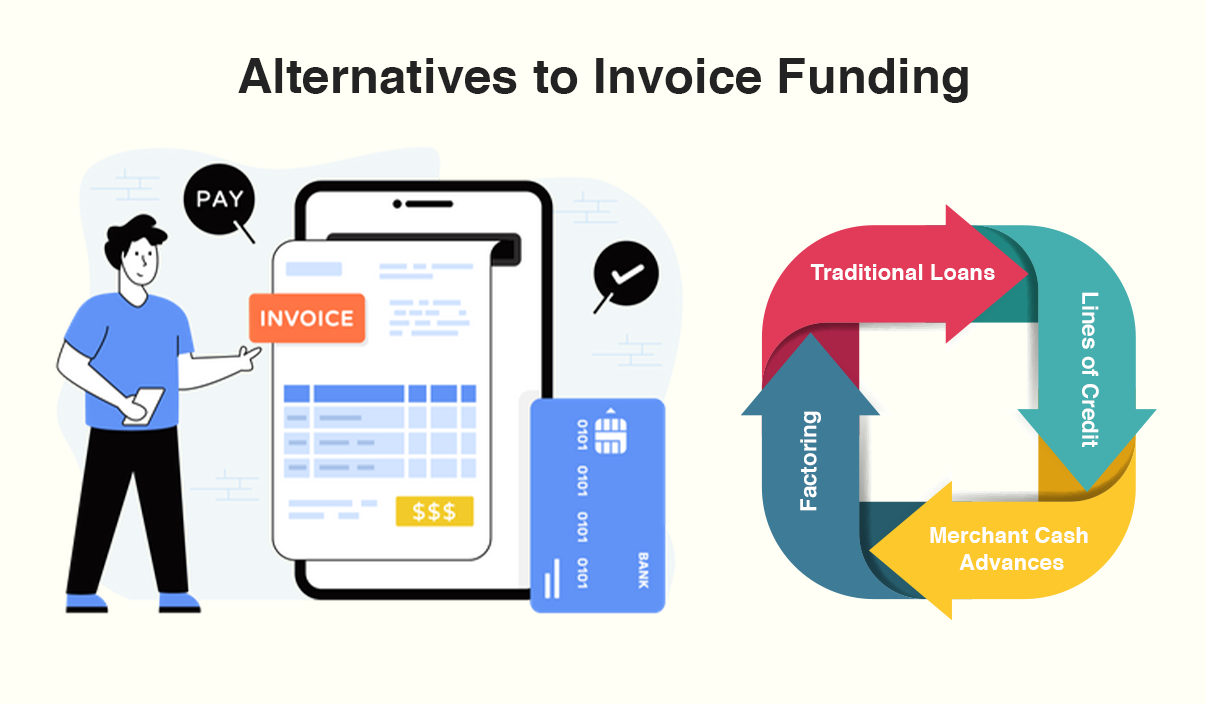

While invoice funding can be a helpful tool, it’s important to understand other potential solutions and compare their suitability for your situation:

Traditional Loans: Banks and other financial institutions may offer business loans, but obtaining approval can be time-consuming and require strong creditworthiness.

Lines of Credit: A line of credit provides access to a revolving pool of funds you can draw upon as needed, but qualifying for and maintaining one can be similar to a traditional loan.

Merchant Cash Advances: This option involves selling a portion of your future credit card sales in exchange for immediate cash, but the fees can be high compared to other options.

Factoring: Similar to invoice funding, the financing company typically assumes ownership of the invoice and collects payment directly from your customer, taking on the risk of non-payment.

The Bottom Line: Is Invoice Funding Right for You?

Ultimately, the decision of whether invoice funding is right for your business depends on your specific needs and circumstances. If you are facing cash flow challenges due to slow-paying customers and traditional financing options seem out of reach, then invoice funding can be a viable solution to explore.

Additional Tips for a Successful Invoice Funding Experience

◎ Maintain strong creditworthiness: A strong credit history for your business and your customers can lead to more favorable terms and rates from invoice financing companies.

◎ Negotiate terms: Don’t be afraid to negotiate fees and terms with different providers to secure the most competitive and cost-effective solution for your business.

◎ Communicate clearly with customers: Inform your customers upfront about using invoice funding and any potential impact on their payment process.

◎ Maintain accurate and organized records: Having clear and up-to-date records of your invoices and customer information is crucial for a smooth and efficient experience with invoice funding.

Technical Considerations for Invoice Funding

Beyond the basic understanding, delving into some technical aspects of invoice funding can provide a deeper comprehension:

Discount Rates and Fees:

● Discount Rate: This fee, expressed as a percentage, represents the cost of borrowing the money against your invoice. It’s typically calculated based on the invoice amount, term length, and risk associated with your customer’s payment history.

● Additional Fees: Besides the discount rate, some financing companies may charge additional fees, such as application fees, processing fees, and account maintenance fees.

Term Length and Early Payment Options:

Term Length: This refers to the duration for which the financing company advances you the funds, typically ranging from 30 to 120 days.

Early Payment Discounts: Some financing companies offer discounts on their fees if your customer settles the invoice earlier than the agreed-upon term. This can be beneficial if you anticipate prompt payment from your customer.

Collateral Requirements:

In some cases, invoice financing companies may require additional collateral beyond the unpaid invoices themselves. This could include personal guarantees from business owners or liens on assets.

Impact on Financial Statements:

Invoice funding can affect your company’s financial statements in various ways:

i. Accounts receivable: The outstanding invoice amount is typically removed from your accounts receivable and replaced with a payable to the financing company.

ii. Short-term liabilities: The advance received from the financing company is reflected as a short-term liability on your balance sheet.

iii. Interest expense: The discount rate paid to the financing company is recorded as an interest expense in your income statement.

Understanding these technical aspects can empower you to make informed decisions and negotiate effectively with invoice financing companies.

Conclusion

Invoice finance can be a useful tool for firms struggling with cash flow owing to slow-paying customers. If you are considering invoice finance, remember to investigate different providers, understand the associated fees, and select the appropriate invoices to create a positive experience.