Reordering stock sounds simple: when shelves run low, you place an order. Yet behind that basic process lie methods and insights that large retail chains have refined over decades. For local stores—even those with loyal customers and strong roots in their community—many of these methods remain unknown or unused. In this article, we’ll look at the key practices big chains use, examine the pitfalls local stores often face, and offer clear steps any small retailer can take today to bring their retail reordering strategy up to par.

Introduction: A Tale of Two Shops

Imagine two corner stores in the same neighborhood.

- Store A, part of a national chain, always has fresh bread, popular snacks, and pet food in stock.

- Store B, a family-run shop, often runs out of the same items, then suddenly finds itself with a surplus of less-requested goods.

Customers wait in Store A, browse, and walk out happy; in Store B, they shrug and head elsewhere. What is Store A doing that Store B does not?

Big chains have a system: they gather data, use it to predict what customers will buy, and then move stock automatically. Local stores often rely on memory or manual counts, and that can lead to empty shelves or wasted inventory.

1. Why Retail Reordering Strategy Matters

At first glance, reordering is simply keeping products on the shelf. But in practice, a robust retail reordering strategy affects cash flow, customer satisfaction, and overall profitability.

- Cash Flow

- Too much stock ties up funds in inventory you cannot sell quickly.

- Too little stock means missed sales and unhappy customers.

- Too much stock ties up funds in inventory you cannot sell quickly.

- Shelf Space

- Space is limited. Every extra unit of a slow-moving product displaces a high-demand item.

- Space is limited. Every extra unit of a slow-moving product displaces a high-demand item.

- Customer Trust

- Consistent availability builds loyalty. Frequent stockouts send shoppers elsewhere.

- Consistent availability builds loyalty. Frequent stockouts send shoppers elsewhere.

- Supplier Relations

- Buying in the right amounts can earn you better pricing or credit terms from suppliers.

- Buying in the right amounts can earn you better pricing or credit terms from suppliers.

Getting reordering right strikes a balance: enough product to meet demand without costly overstock.

2. The Large-Chain Playbook

The core of a successful retail reordering strategy for big chains is data-driven forecasting, moving beyond guesswork.

A. Historical Data and Demand Forecasting

Chains capture every sale, down to the hour and even the minute. They analyze patterns—weekdays vs. weekends, seasonal shifts, promotions—and forecast future demand. These forecasts drive automated orders sent to distribution centers.

- Why it works: By studying past patterns, chains spot trends before they become a problem, such as rising snack sales on Friday evenings.

B. Automated Ordering Systems

Once forecasts are set,the software compares current stock levels against projected demand. When an item nears its reorder threshold, the system generates a purchase order without human intervention.

- Why it works: This removes guesswork and delay. Orders go in at the same time each cycle, and staff don’t need to stop daily duties to decide what to buy.

C. Centralized Purchasing

Rather than each store buying on its own, chains negotiate terms at headquarters. This yields:

- Bulk discounts

- Better credit terms

- Access to exclusive products

Local stores often lack the volume to get comparable pricing or flexible payment options.

D. Real-Time Visibility Across Locations

Large chains know exactly how much of each item exists in every store and warehouse. They can reroute stock between outlets, move goods from slow stores to busy ones, and plan shipments in advance.

- Why it works: Even if one store overorders, the excess can be sent to another location in need.

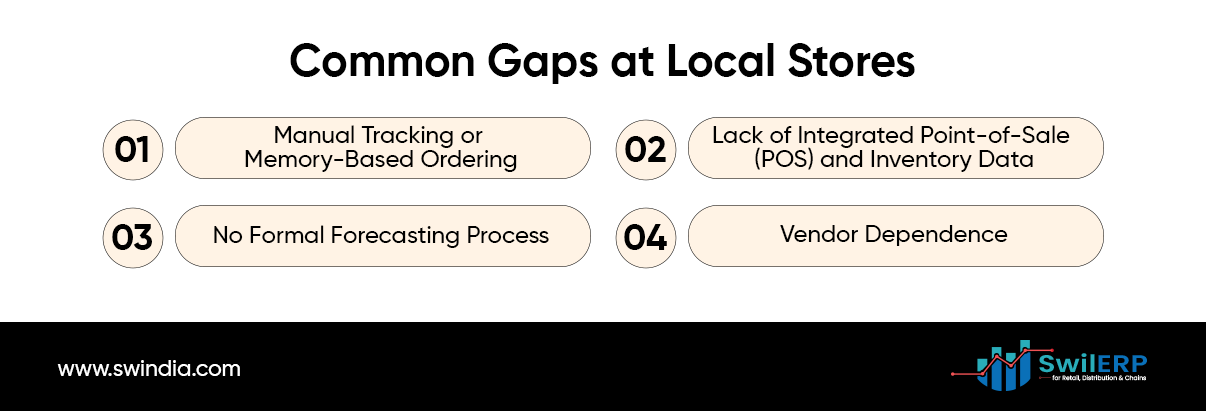

3. Common Gaps at Local Stores

Local retailers face challenges that chains have already solved:

1. Manual Tracking or Memory-Based Ordering

Manual reordering pitfalls often include overstocking, stockouts, and missed sales opportunities—all of which a smart retail reordering strategy can fix.

2. Lack of Integrated Point-of-Sale (POS) and Inventory Data

Many small shops use a basic cash register or a simple POS that records sales but does not link to stock levels. Without this link, reordering is always reactive.

3. No Formal Forecasting Process

When the boss “knows” Fridays are busy, orders may rise in anticipation—but how much? Without data, decisions rest on gut feeling, which can fail when patterns shift (e.g., a new competitor opens).

4. Vendor Dependence

Local stores often stick to one or two suppliers, missing better deals or products. They may reorder minimum quantities just to keep the relationship, even if they don’t need all that stock.

4. The Consequences for Small Stores

Poor reordering practices hurt local shops in several ways:

- Stockouts: Missing popular items drives customers to competitors. One empty shelf can cost dozens of sales over time.

- Overstock: Excess items take up space, risk spoilage (especially with perishable goods), and lock up cash that could be invested elsewhere.

- Price Pressure: Without bulk buying power, small stores pay more per unit, leading to higher prices or lower margins.

- Customer Frustration: Shoppers expect consistency. If they can’t find their usual brand of cereal, they may not return.

5. Practical Steps for Local Stores Today

Even without a corporate IT budget, you can improve reordering:

A. Use Basic Inventory Tools or POS Features

To implement a smarter retail reordering strategy, start by activating basic inventory features in your POS system.

- Many modern POS systems include inventory tracking. Activate these functions.

- If you lack a digital POS, consider free or low-cost cloud-based options that track sales and stock.

B. Record Daily Sales and Stock Levels

- At the end of each day, note how many units of key items.

- Compare this to your current on-hand stock.

C. Calculate Reorder Points with Simple Math

- Average Daily Sales: Total units sold over a period ÷ number of days.

- Lead Time: Days between placing an order and receiving goods.

- Safety Stock: Extra units to cover unexpected demand or delays.

Reorder Point = (Average Daily Sales × Lead Time) + Safety Stock

This formula tells you the minimum stock level before you should reorder.

D. Negotiate Flexible Terms with Suppliers

- Show them your daily sales figures to justify smaller, more frequent orders.

- Ask for shorter lead times or partial shipments so you don’t need to buy large volumes at once.

E. Group Items by Sales Velocity (ABC Analysis)

- A-items: Top 20% by sales value (fast sellers).

- B-items: Next 30%.

- C-items: Remaining 50% (slow movers).

Focus your tightest control on A-items—order these more often and with precision. Check C-items less frequently to save time.

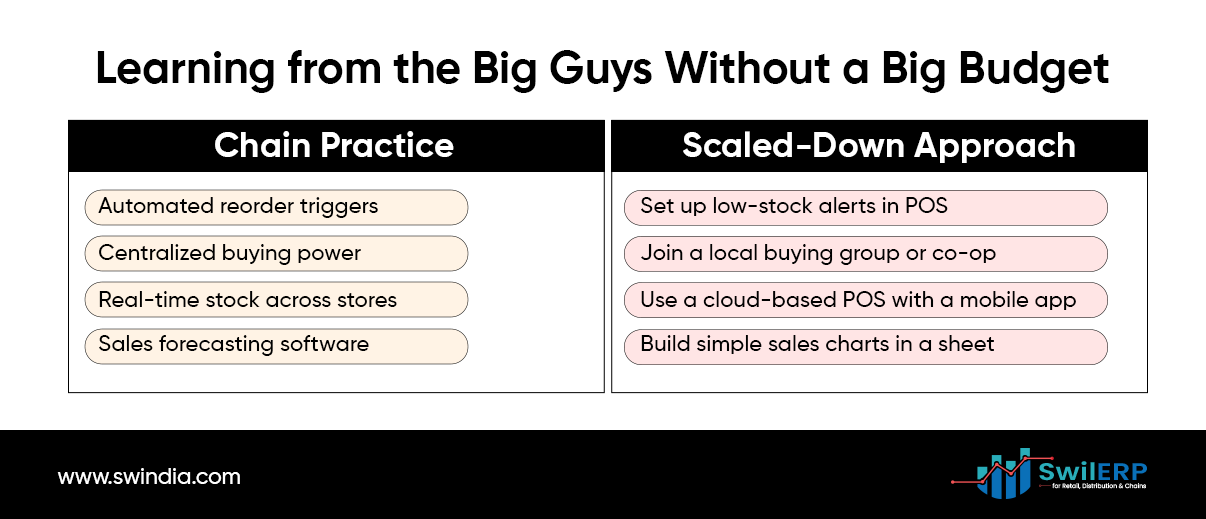

6. Learning from the Big Guys Without a Big Budget

Large chains have deep pockets, but many of their ideas scale down:

| Chain Practice | Scaled-Down Approach |

| Automated reorder triggers | Set up low-stock alerts in POS |

| Centralized buying power | Join a local buying group or co-op |

| Real-time stock across stores | Use a cloud-based POS with a mobile app |

| Sales forecasting software | Build simple sales charts in a sheet |

Low-Cost or Free Tools to Consider

- Cloud POS Services: Some offer free tiers for very small shops.

- Spreadsheet Templates: Pre-made reorder calculators are available online at no cost.

- Mobile Inventory Apps: Many let you scan barcodes and track stock on your phone.

7. The Payoff: Real-World Gains from Better Retail Reordering Strategy

Background

- The Corner Bookshop, a 10-year-old family store, sold an average of 5 paperbacks daily.

- They ordered 100 units of a popular author’s new release, but only sold 60 in the first month—shelves filled up, and cash flow tightened.

- Meanwhile, certain children’s titles flew off shelves, and they kept running out.

Actions Taken

- Data Tracking: They recorded daily sales for each book.

- Reorder Point: Calculated that paperbacks sold at 5 units per day, with a two-week supplier lead time, plus a safety stock of 20 units.

- Reorder Point = (5 × 14) + 20 = 90 units.

- Reorder Point = (5 × 14) + 20 = 90 units.

- Vendor Talks: Showed these figures to their distributor, who agreed to smaller, twice-monthly shipments.

- Focus on Fast Movers: Checked “A” titles weekly, “B” titles bi-weekly, and “C” titles monthly.

Results

- Stockouts of bestsellers dropped by 80% in two months.

- Overstock on paperbacks fell by 50%, freeing up cash for new releases.

- Customer visits rose as readers found their favorite authors in stock.

Conclusion: Taking the First Step in Retail Reordering Strategy

Local stores need not feel left behind. By borrowing a few key tactics from large chains—tracking real sales data, setting clear reorder points, and negotiating smarter with suppliers—any retailer can improve stock availability and protect cash flow. The journey begins with small, steady steps:

- Activate basic inventory features in your POS.

- Record daily sales of top items.

- Compute reorder points with a simple formula.

- Divide products into A, B, and C groups.

- Talk to suppliers armed with real numbers.

With these practices in place, local shops can match—or even surpass—the shops down the block. Your community depends on you; give them the reliable service they deserve. And as you refine your process, share your successes and questions with fellow store owners—after all, local commerce thrives when we learn together.