Central banks are important players in the banking system and play an important role in the economy. They are responsible for maintaining a stable financial system and providing emergency assistance to banks when needed. In addition, central banks can provide monetary policy support to the economy by printing money. They also work with other institutions, such as commercial banks, to help manage cash and liquidity in the economy.

Central bank corporate net banking is a system in which banks work together to offer customers access to funds through a single account. This system allows institutions to offer more customer service and helps reduce costs associated with separate accounts.

Central bank corporate net banking is a way for banks to connect with each other and make loans more easily. This service is especially beneficial for small banks and depositories, as it makes it easier for them to borrow money and make loans. When used correctly, Central bank corporate net banking can provide a strong link between banks and help reduce the risk of coordination.

Article Content-

- CBI Net Banking

- What are the Benefits of using CBI Net Banking?

- CBI Net Banking Signup

- CBI Net Banking login

- Check Balance of Central Bank of India via Net Banking

- The reason why CBI Net Banking is an ideal choice for online banking

- FAQS of CBI Net Banking

- Conclusion

CBI Net Banking

CBI Net Banking is a banking service offered by the Central Bureau of Investigation (CBI). It allows users to access their bank accounts and make transactions online. CBI Net Banking is available in English and Hindi.

CBI Net Banking was launched in November 2014 as part of the agency’s efforts to improve customer service and increase transparency across its operations. The platform was initially available only to registered users of the CBI’s e-wallet, Bharat Interface for Money (BIM). In February 2017, it became available to all customers of select banks operating through BIM.

CBI Net Banking offers several features that are unique to the service. These include the ability to view account balances, make transfers between accounts, and track your spending history. Customers can also use CBI Net Banking to request loans from their bank account providers.

What are the Benefits of using CBI Net Banking?

There are many benefits of using CBI net banking, which include:

- You can handle all of your day-to-day financial requirements, including managing your bank accounts, sending money, and:

- Check the balances in your accounts right now.

- View details regarding your loan and overdraft accounts.

- Check your most recent bank and credit card transactions and bank and credit card statements.

- Verify whether the check you sent has been cashed. Remit your recurring electric expenses.

- Money transfers to both CBI and non-CBI bank accounts are permitted.

- Configure automatic payments.

- You can move money between your savings and checking accounts.

- Make alterations to your personal data.

- View the specifics of your account.

CBI Net Banking Signup

For access to this service, you must have an active CBI credit card or savings account.

- On the CBI Internet Banking Homepage, click “Register for Internet Banking.

- Complete the required fields.

- As long as you abide by the password policy, you are free to choose your username and password.

You’ll need a working phone number or email address that has already been registered with the bank, as well as the number from your Emirates ID or passport.

Please let us know in-branch or by calling 800224 if any of the information listed above is inaccurate in our databases. If your personal information is not up to date, you will be unable to register for internet banking. When you open your account in the branch, you can choose whether to enroll in internet banking.

CBI Net Banking login

This is a rather simple process if you’re used to using the online features. With the help of this CBI Net Banking Login capability and your specific login information, you may now access your bank.

- On centralbankofindia.co.in, choose Internet Banking from the menu. Simply click on it to and open it.

- Selecting Personal Internet Banking is recommended. Login

- Simply click on the Visit the Login page to continue.

- User ID and Password fields should be filled in. For the captcha code

- Select the page, then click the Login button to continue.

The website will accept your login information and take you to the Central Bank of India Net Banking Customer Home Page based on your access.

No one else has access to this page; it is only available to you.

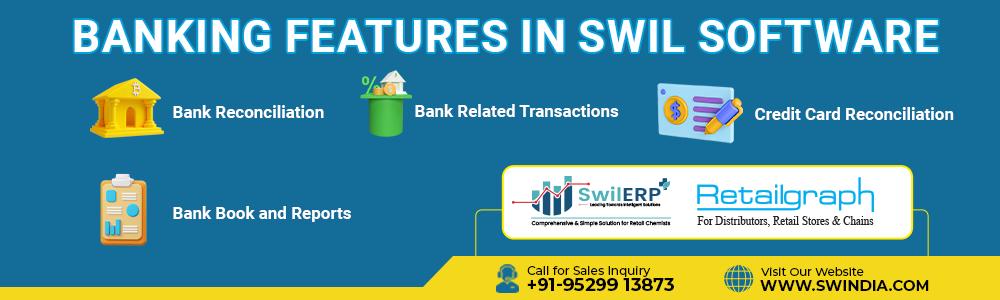

Check Balance of Central Bank of India via Net Banking

All of its account holders have access to net banking through the Central Bank of India.

Individuals who have signed up for Central Bank of India Net banking users can use the same Central Bank of India website to check their account balance.

After successfully logging in, you can see your account summary to check your balance using Net Banking.

Additionally, customers can use the net banking capability to transfer funds, request services, conduct transactions, and pay utility bills.

The reason why CBI Net Banking is an ideal choice for online banking

CBI Net Banking is a banking platform that allows users to conduct transactions online. The platform offers a variety of benefits, including convenience, security, and efficiency. Here are five reasons why CBI Net Banking is an ideal choice for online banking:

1. Convenience

CBI Net Banking makes it easy to access your account information and make transactions from anywhere in the world. You can also manage your finances in one place without having to search through multiple websites.

2. Security

With CBINetBanking you have protected against identity theft and other cyber-attacks thanks to the secure encryption of your data transmissions.

3. Efficiency

With CBI Net Banking, you can access your account information and make transactions quickly and easily. You can also save time by using the platform’s automated transactions and withdrawal features.

4. Accessibility

CBI Net Banking is available in both English and Hindi languages, making it accessible to a wide range of users.

5. Interactivity

CBI Net Banking offers users the opportunity to participate in online discussions and engage with other users to get advice on financial matters.

FAQS of CBI Net Banking

1. How can I get the Central Bank of India Corporate ID?

The Central Bank of India (CBI) offers corporate identity cards to its customers. These cards allow for the identification of a company’s representatives and employees. The CBI Corporate Identity Card is a unique identifier that can be used to access banking services, and ensure authorizations, and other routine transactions with the CBI. The CBI Corporate Identity Card is also good for marketing purposes as it allows businesses to claim credit or debit card authorizations from the Central Bank of India.

2. What is a corporate banking service?

Corporate banking service is a type of financial product offered by banks to their clients. A corporate banking service can include services such as checking and savings accounts, credit cards, and mortgage financing. Corporate banking services are often provided as an add-on to a bank’s regular lending services.

3. What is the Central Bank CIF number?

The Central Bank CIF number is a unique identifier for a financial institution. It is used to identify and track the account of a financial institution in the central bank system. The Central Bank CIF number can be used to obtain information about an account, such as the amount of money in it, the type of account, or the value of assets in it.

4. How can I get my Central Bank CIF number online?

When you file for bankruptcy, your creditors will likely ask for your Central Bank CIF number. This number is used to track and manage your account with the bank. You can get your Central Bank CIF number online by visiting a website such as bankrate.com or creditcardwaiver.com.

5. How do I activate my CBI debit card?

CBI debit cards are a convenient way to spend money at participating merchants. To activate your CBI debit card, you need to provide your bank account number and other information. Activate your CBI debit card by visiting the merchant’s website and completing the activation process.

6. How can I activate my CBI mobile banking?

Activating your CBI mobile banking is a simple process that you can do in minutes. By following these simple steps, you will be able to start using your CBI mobile banking account and enjoy all the advantages that this type of account has to offer.

7. How can I register my central bank email ID online?

After registering with your central bank, you’ll need to create an email identifier. This identification will allow you to access your account and receive notices and notifications from your central bank. You can register your email identifier online, or through our customer service team.

Conclusion

Central bank corporate Net Banking is an excellent way for businesses and individuals to connect with one another and conduct business. It is easy to sign up and use and has many benefits that include reductions in costs associated with traditional methods of banking.

India’s central bank is known as the Reserve Bank of India. It was established on April 1, 1935, by combining the Imperial Bank of India and the Currency Board, and is mostly in charge of developing monetary policy. A new Operate was created on December 19, 1992, to serve as the RBI’s “finance ministry.” Significant changes were made to this Act in 2012. (To satisfy universal standards).

Effective management, CBI net banking reform, and competition law are the three core objectives of the RBI. The CBI bank, which has its headquarters in Mumbai, is well known for offering a variety of services, including CBI net banking.

Central bank corporate Net Banking is a great way to get your banking needs met quickly and easily. Sign up today and start using Central bank corporate Net Banking.