Technology always serves you wherever you are selling something or purchasing it. Every business, small or big, is being streamlined by its use. Accounting, without exception, reflects the financial health of any business. It involves very large accounts and operations that need to be done carefully. In this case, accounting software is the right solution and is a boon for businesses.

Article Content-

- Statistical Growth of Accounting Software Market

- A Brief Note on Accounting Software and Introduction of GST

- 9 Things to keep in mind while choosing a GST accounting Software

- Conclusion

Statistical Growth of Accounting Software Market

As per research, the accounting software market is expected to grow at a CAGR of 8.5 % during the forecast period 2019 – 2024.

In the last decade, the financial and accounting software market has seen many changes. One such significant change occurred in the Indian taxation structure in July 2017. The government of India introduced the GST (Goods and Services Tax). The declaration changed the entire taxation structure and made businesses read to consider the policy of following new statutory norms.

A Brief Note on Accounting Software and Introduction of GST

Accounting software is a one-stop solution to all financial functions within the organization. It helps companies perform financial accounting efficiently. And, reduce the risk of any operational fault that leads to immense business losses.

With the introduction of GST in India, there have been drastic changes in traditional accounting, which GST-based accounting software can quickly deal with.

With the right GST accounting software, you don’t have to worry about changing the taxation system in India. Paired with the right accounting software, you stay updated with the latest compliances, easily manage your finances, and get the convenience of filing GST online for your business.

Keytakeaways of GST Accounting Software

- Filing a GST return becomes easy when you have the right accounting software for your business.

- It helps you throughout the GST filing process, saves time, excels in the long process, and stops you from making big mistakes.

- GST software platform comes in two packages, depending on which GST solution you prefer. One is GST accounting software, and the other is GST filing software.

- Each has its characteristics and purpose. While selecting GST accounting software, ensure that the software you choose has all the necessary features required for your business.

9 Things to keep in mind while choosing a GST accounting Software

1. Knowing Business Accounting Needs

Identifying the purpose of adopting accounting software should be the first step that needs to be taken care of.

- Do you need a tax filing system in your accounting software or not?

- Does your software generate different reports or not?

- Is your software cloud-based or not?

- How safe is your data in your software?

- And it is also necessary that in the future, your accounting software can be easily integrated with any third-party software.

It enables the business to manage business finance remotely efficiently.

2. Business Data Security

Security is one of the most critical assurances for GST software usage. This is necessary to protect confidential business information, which can become a threat to your business if such information is misused or stolen. This can lead to loss of money, effort, time, and relevant business information.

An ideal GST accounting software should have appropriate security standards that help taxpayers get rid of data breaches. It should be obligatory that GST software should be equipped with the highest standard encryption technologies that implement some important security features such as password protection, proper backup of accounting information, and other virus/threat protection, etc.

3. Inspection for Scalability

Often, the decision to adopt accounting software is based only on the present scenario and not the future. Such a scenario may lead to adverse situations in the future where the business will have to be shifted to the new system according to the time.

To do this will be the demand of the market. But choosing the futuristic accounting software is a complicated and time-consuming process.

So while choosing GST-based accounting software, you should invest in the right business software that can be extended per the requirement.

4. User Interface

A key feature that is always appreciated by the user is the software interface. It is always useful to develop techniques that are easy to understand and accept by non-technical users. For GST filing, a simple and flexible user-interface is required. A software interface is consisting of informative dashboards and informational reports (MIS) that facilitate users to make quick decisions and conduct transparent operations.

The GST software should provide a service where the user gets real-time information related to the new GST update and knows the deadline for GST filing. Also, the GST software should connect to the GSTN (Goods and Services Tax Network).

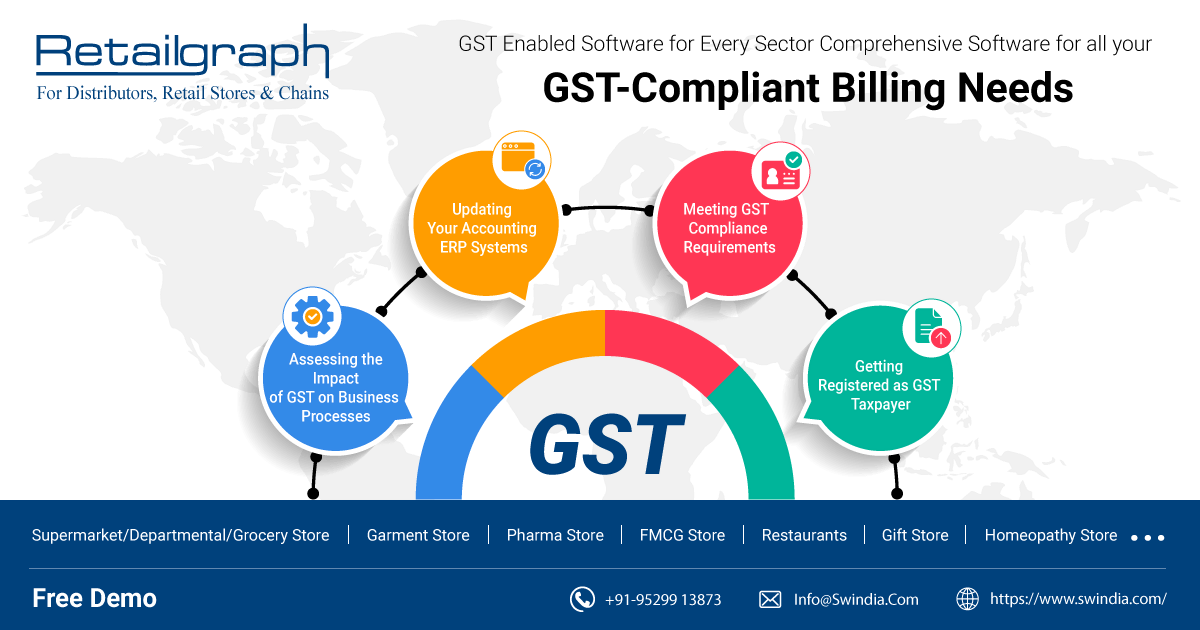

5. Meeting GST Compliance Requirements

To get GST-based accounting software, the software must comply with financial records laws. It helps the tax authorities to access the complete trail of invoices submitted by the taxpayers in the GST portal.

It takes time for accountants to follow such compliance rules manually. Businesses must therefore use accounting software to streamline these processes, automate the creation of e-way bills and e-invoices, and handle other compliance obligations.

6. Multi-Platform Adaptability

Multi-platform adaptability is required for the GST software you purchase. It allows users to file their GST tasks or GSTs at any time on multiple platforms, including desktops, tablets, laptops, or mobile phones. This will facilitate timely online return filing and gives taxpayers relief from the taxation process.

7. Online and offline capabilities

Both online and offline operating modes add new capabilities to GST software. This allows you to work even if you are not on an internet connection. A online GST accounting software should include online capability into the offline mode, for rural areas where people face the issue of network connectivity. It gives the organization a better working environment without pushing the data to the GSTN every time.

8. Customer Support

Excellent customer support is required for the purchased GST software solution. This is because it helps taxpayers understand the GST software and make the best possible use for their business needs. The support makes it easy for taxpayers and accounting professionals to learn about the diverse functionalities of GST software. Furthermore, in this way, the developers understand the business and accounting needs of the customers and suggest the best solutions.

That is why you should choose a GST software that provides real-time support and site-visits when needed.

9. Cost-Effective

Cost is another major factor that should be considered when purchasing GST software. GST billing software is available in the market with various features and with single or multiple users per license. Cost depends on two factors: business requirements and budget. Business owners and accounting professionals have to choose GST software according to their business sizes (large/small) and requirements (online/offline or both).

Note: Now you can file NIL returns through SMS too. You can see the procedure for filing NIL returns here.

Conclusion

Finding the right GST accounting software for your business is not an easy task. Business owners invest their time and money, so they do not want to choose the wrong one and also do not want to move from one software to another. Thus, before purchasing GST accounting software India, it is better to take time, research, and decide your requirements. This blog will help you to explore advanced GST software with the necessary tools and smart features.

In the market, SWIL is the name of trust in the service of best GST accounting solutions in India. Our team of experts has relevant experience in GST based solutions. They give you quick assistance when needed, within your budget and time frame.