In the confusing scene of bookkeeping, accuracy is vital. For accountants, financial managers, and business owners, understanding the nuances of contra entries is not just advisable but essential.

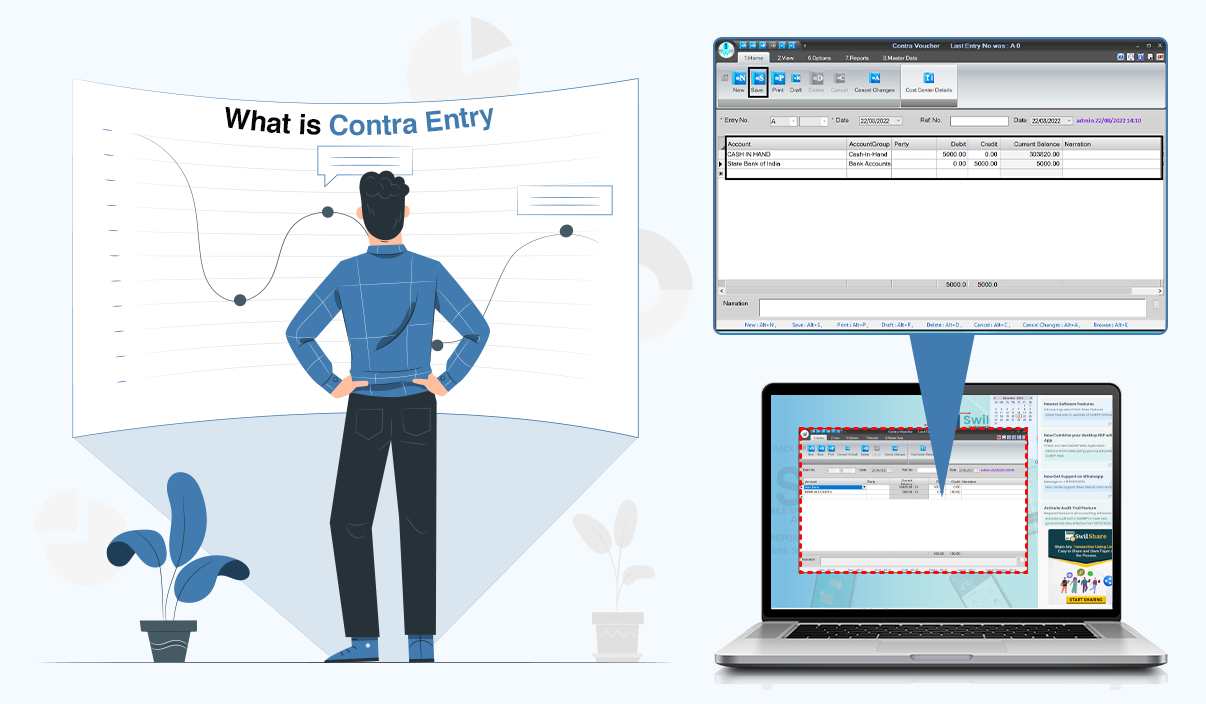

What is Contra Entry: A Fundamental Explanation

At its core, a contra entry is a unique accounting transaction that involves offsetting the effect of an initial entry to create a more accurate representation of financial reality. In simpler terms, it’s the counterpart to a primary entry, ensuring a clear and accurate depiction of a financial event. Imagine it as a financial seesaw that stays in balance across a vast array of debits and credits. Without a solid understanding of this central idea, monetary records risk becoming contorted, possibly prompting misinformed business choices.

Read also : Figure out What, Why & How of Accounting & Finance in ERP Environments

The Purpose and Importance of Contra Entries

For what reason are contra sections so vital? The answer lies in their ability to correct financial inconsistencies. Professionals can use contra entries to repair errors, reflect transactions, and account for contra transactions. Without a firm grasp of contra entries, financial statements risk misrepresentation, leading to misguided business decisions. They go about as the caretakers of monetary precision, permitting experts to explore the complicated landscape of deals with certainty.

Recording Contra Entries: The Process Explained

In the domain of double-entry accounting, the process of recording contra entries is vital. This part will dive into the quick and dirty subtleties of how experts can precisely record contra sections to guarantee their books precisely reflect monetary occasions.

From the initial recognition of an error to the correction process, understanding the delicate dance of contra entry recording is essential for maintaining the harmony of financial records.

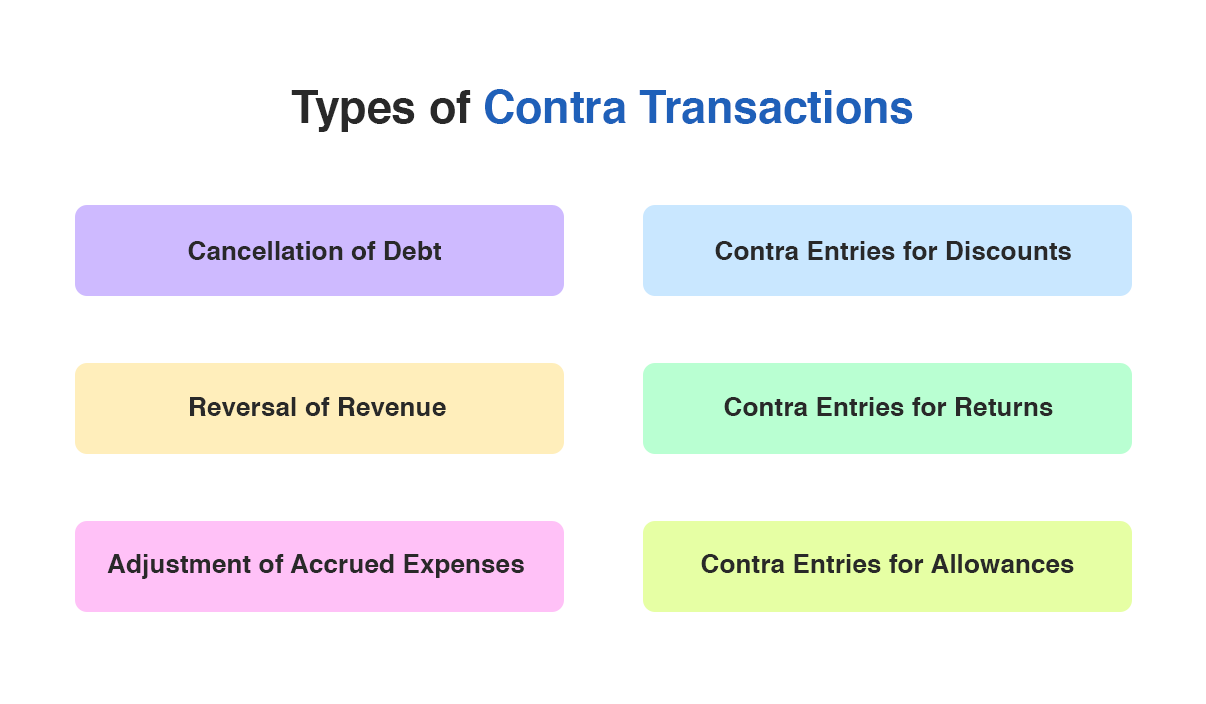

Types of Contra Transactions

Contra transactions come in various forms. Whether it’s the debt cancellation, revenue reversal, or other extraordinary situations, this segment will investigate and characterize the various kinds of contra exchanges. A thorough comprehension of these categories is required for professionals to handle the complexities of financial transactions. Let’s delve into the different types of contra transactions-

1. Cancellation of Debt:

Explanation: When a debt that was previously recorded is deemed uncollectible, a contra entry is made to offset the initial debt entry.

2. Reversal of Revenue:

Explanation: In cases where revenue was initially recognized but needs to be reversed, a contra entry is employed to offset the revenue entry.

3. Adjustment of Accrued Expenses:

Explanation: Accrued expenses, which are costs that have been incurred but not yet paid, may need adjustment. A contra entry is used to correct the accrued expense entry.

4. Contra Entries for Discounts:

Explanation: Discounts, both cash, and trade, may necessitate contra entries. This ensures that the financial records accurately reflect the adjusted transaction amount.

5. Contra Entries for Returns:

Explanation: When customers return goods, a contra entry is made to account for the return and adjust the corresponding revenue entry.

6. Contra Entries for Allowances:

Explanation: Allowances, such as doubtful accounts or sales returns, may require contra entries to adjust the corresponding accounts.

Contra Entry Examples in Accounting

Theory becomes tangible with real-world examples. This segment will give pragmatic situations, strolling experts through normal contra entries.

Simple Reversals: Cancellation of a Check

Imagine a scenario where a business issues a check to a supplier but later discovers an error in the amount or realizes that the payment was not necessary. To rectify this, a contra entry would be made to cancel the effect of the initial check issuance. This direct model outlines how contra passages go about as financial erasers, revising errors in the records.

Intricate Transactions Involving Contra Accounts

Now, consider a more complex situation involving contra accounts. Let’s say a company overestimates its expected sales revenue and records the excess in its regular revenue account. To rectify this, a contra revenue account is established to offset the overstatement. This nuanced model grandstands how contra accounts assume a vital part in introducing a more exact financial picture by checking misclassifications or mistakes in the normal records.

These models go about as a compass, directing experts through the different territory of contra sections.

Generally, these models act as a practical aide, improving hypothetical information with the insight acquired from active application in the embroidery of bookkeeping rehearses.

Read Also : 7 Strategies to Improve the Effectiveness of your Accounting Software

Navigating Misconceptions: Understanding Contra Entries Correctly

Misconceptions can hinder the application of contra entries.We dismiss myths about contra entry and dispel misunderstanding, allowing professionals to tackle financial tasks with correct understanding confidently and heightened confidence.

Clarity on misconceptions is the first step toward mastery.

Best Practices for Accurate Contra Entry Recording

Accuracy is a hallmark of effective accounting. Look at it as a tool stash for financial experts, giving the essential instruments to explore the intricate scene of contra exchanges with artfulness and precision.

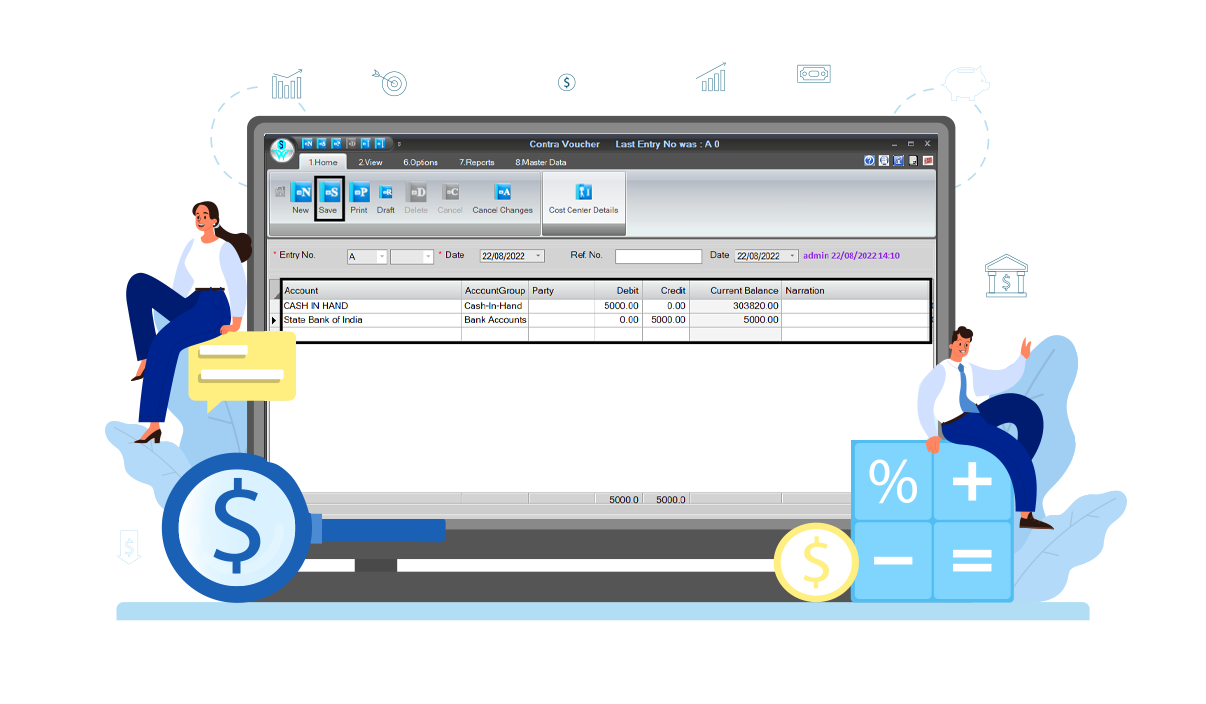

Utilizing Modern Accounting Software for Contra Entries

The advent of technology has revolutionized accounting practices. This part investigates the job of current bookkeeping programming in overseeing contra passages effectively. Embracing innovation smoothes out processes as well as upgrades precision and lessens the probability of human mistake. Present day bookkeeping programming alters contra passing the executives, upgrading effectiveness and lessening mistakes through smoothed out processes in the computerized scene.

Read Also : Why Computerized Accounting Software is a necessity for Small Business: Meaning, Types, and Benefits

Conclusion

This guide has strolled you through the central ideas, the significance of contra sections, the recording system, kinds of transaction, real-world examples, and best practices. Remember that a good understanding of contra entries is your compass for financial precision as you traverse the complex world of accounting. Empower progressing learning and utilization of these ideas to guarantee that your financial records stay a genuine impression of your business’s reality.