Introduction

The process of comparing supplier invoices with

- Purchase orders,

- Delivery notes, and

- Actual inventory will be one of the biggest stresses a financial team will experience.

Every month, huge numbers of invoices arrive, and each vendor or supplier usually demands urgent payment! However, supplier reconciliation is a crucial process that makes sure your company gets what it ordered, pays for it, and isn’t overcharged.

Like any other reconciliation difficulty, it can be readily resolved if the proper combination of procedures, employees, and technology is used.

Article Content-

- What is Invoice automation?

- How Does Automated Invoicing Function?

- How might automation be used to simplify the process of reconciling invoices?

- Benefits of automated invoice processing

- Which Individuals Can Benefit from Automated Invoicing?

- Conclusion

What is Invoice automation?

Invoice reconciliation is a business procedure that protects against overspending. Invoices and general ledger accounting records are compared as part of a checks and balances system. When done correctly, it avoids

- Duplicate entries and/or

- Unnecessary payouts and

- Maintains the right level of balance in the books.

Reconciliation of invoices is a tool for retaining customers. Accurate data and mutual understanding are necessary for enduring customer and supplier partnerships. Too many business partnerships have failed because of a “feeling” of improperness or inaccuracy. By reconciling your numbers, you may get the clarity you need to make sure all of your data is correct.

Businesses utilize invoice processing automation software to automate supplier invoice payments, which eventually helps to streamline accounts payable processes. With automated invoice processing, payments can be issued in a few minutes by quickly obtaining invoice data from a system and smoothly transferring it to your ERP or accounts payable system.

How Does Automated Invoicing Function?

When the accounting department receives an invoice from a supplier, the traditional method of managing invoice documents gets underway. It has been matched and approved at this point. Usually, further approval is required if the invoice’s total represents a significant payout.

Then it needs to be “posted” for payment in the system, where it must be inputted. Payment is then made. Depending on the business, the manual invoicing process occasionally requires as many as 15 steps. This takes a lot of time, especially if you have several invoices to process.

Automated invoicing makes things simple. The digital accounting system scans and inputs the invoice as soon as it is received. Invoice capture is a type of data capture that eliminates hours of human data input. The data will then be transformed into a document that can be searched using text by the invoice automation software.

The invoice data can be retrieved and mapped in order for the automated management system to remember which fields to capture and register into the ERP system. This data contains things like the

- Supplier’s name,

- The price,

- The quantity, and so on.

After that, the necessary parties receive the invoices for evaluation and approval.

How might automation be used to simplify the process of reconciling invoices?

A small business owner’s ultimate fear is complexity. Manual procedures can lead to complex issues that become more challenging to solve as a business expands, particularly when it comes to invoicing and accounting. When you start growing your business, the paper invoicing system you used when you had four vendors and less than ten staff won’t work anymore.

Even in the initial stages of a business, automation can reduce complexity. Consider a reconciliation process that takes place automatically each time you pay an invoice. You can save endless hours reconciling payments and looking for suspicious transactions by connecting those two in real time.

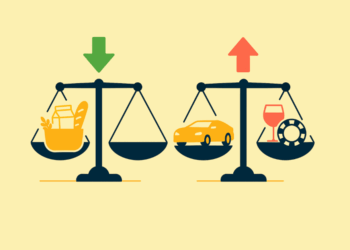

The potential of paying extra or twice for an already-processed invoice is eliminated by automating the invoice reconciliation process. Examining current auto payments made on vendor invoices is another opportunity presented by the implementation of a system like this. Zombies’ spending, as it is also known as when you pay for goods or services that you no longer use or receive.

Your business will encounter

- Delayed data entry,

- A higher risk of human error, and

- Continuity issues during the invoice reconciliation process without automation or accounting software.

Those issues are far less likely with automation. Invoices can be scanned for data entry, and unpaid invoices will automatically carry over to the next billing cycle.

Benefits of automated invoice processing

Using automated invoicing has a lot of benefits. This includes a procurement to pay cycle reduction of up to 80% for a business. Additional benefits include:

- It reduces the rate of errors. Less manual entry means fewer chances for errors.

- It increases approval rates and saves processing time.

- This reduces the cost of labor. Employees can work on more crucial business-related tasks.

- It eliminates double payments and invoices.

- It promotes better relationships. Employees are relieved of tiresome tasks, and vendors experience a more transparent process.

- It reduces the expense of handling invoices manually (postage, paper, etc.).

- Securing early payment discounts is preferable to paying late fees.

Which Individuals Can Benefit from Automated Invoicing?

Businesses of all sizes can benefit from automated invoice processing since the system automates the entire invoicing process, from vendor invoice preparation to payment reconciliation, saving time and money. Before data can be recorded (either digitally or manually) into an accounting system or, in certain cases, ledgers, more traditional invoice processing software requires actual delivery of invoices.

Conclusion

In one way or another, all of these features will be used by the best automated invoice processing software. The sooner an accounting department uses this digital approach, the simpler it will be to concentrate on expansion.

In the future, businesses plan to use mobile devices to manage complex financial operations. In five years, it won’t be necessary to worry about a company that is trapped in the past.

It takes more time to manually process invoices and payments, which leaves you with less time for other activities. When you work with numbers every day, it’s easy for human error to occur.

Businesses will invest exponentially more in connected commerce solutions that automate and streamline important components of B2B transactions, such as three-way matching, as they turn more and more of their attention to digitalization. So that vendors can speed up the processing of invoices and free up resources to concentrate on other important business concerns, businesses will give priority to solutions that increase operational efficiency.